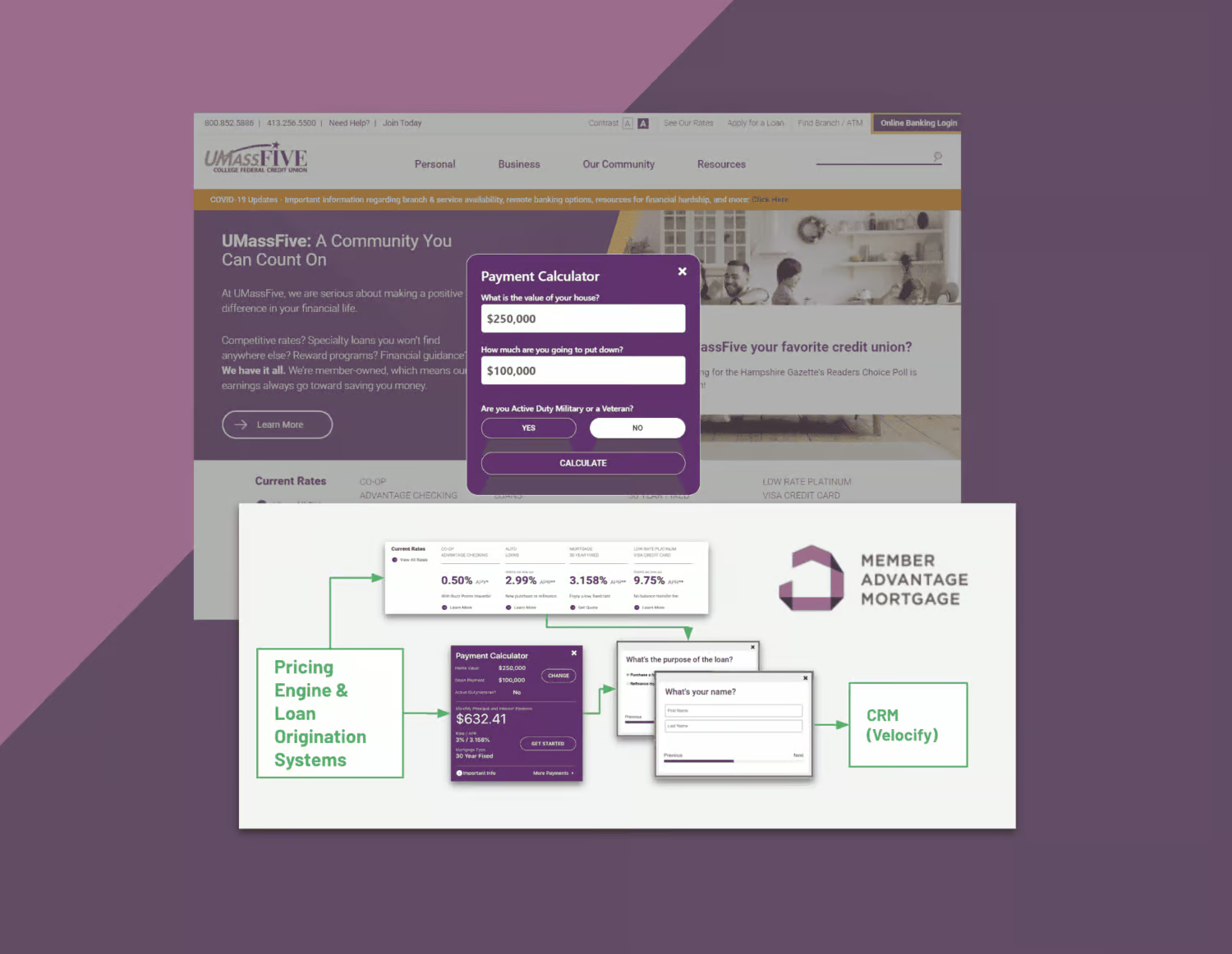

Member Advantage Mortgage is a credit union servicing organization (CUSO) that provides competitively priced mortgage service programs that directly drive value back to their partner credit unions and their members. As a trusted partner in the mortgage lending industry, Member Advantage Mortgage (MAM) looked to leverage Augusto’s knowledge to create a mortgage embedded lead funnel from their partner credit unions websites.

The Problem

Our research into the credit unions’ websites uncovered the complicated UX journeys their customers endured in order to find mortgage rates and products. This included multiple clicks, scrolls, and even outside websites with warning messages shown to members. In other words, the websites were difficult to navigate and customers could not find what they were looking for, causing many missed opportunities for the CU and MAM. Additionally, the credit unions struggled to keep information up-to-date and generate customer engagement.

The Challenges

Transforming a Confusing Journey Across Lenders

The main challenge in this engagement with MAM was making it simple for customers to acquire accurate mortgage quotes, while easily connecting with MLOs for support throughout the mortgage financing process. We also wanted to enable MAM to easily integrate a lead generation strategy from each of their CU partner websites.

An additional challenge was designing widgets in a flexible, easy to implement way. Credit unions don’t usually invest heavily in a full development department, so we guaranteed that their team could easily drop the widgets onto their webpages – leaving them to focus on the work they’re best at.

By implementing our measurement strategy when we delivered the first credit union’s widget package, we were able to instantly watch as new users began interacting with the widgets. We held many conversations to measure our desired outcomes. The significant increase of new leads from MAM’s initial CU partner proved we were on the right track. MAM is now expanding to other CU partners, and we are helping them implement and iterate on their vision. The future seems bright for MAM, and we are thankful to be their digital engineering partner on their path to success!

Why Member Advantage Mortgage Chose Augusto

Recognizing the need for a smoother, simpler customer experience, the MAM team sought Augusto’s help to create easy-to-use embedded design for mortgage payment and rate widgets that could generate customer demand on existing CU partner sites. In addition, it gave MAM a new product to use to attract new credit unions to join their program.

Augusto’s Solution

Easy-to-Use Design Widgets

Augusto delivered a set of mortgage payment and rate widgets that can conveniently be configured and dropped onto each credit union’s website. The design enables them to be embedded with each credit union’s unique branding – including colors, fonts, layout, and sizes.

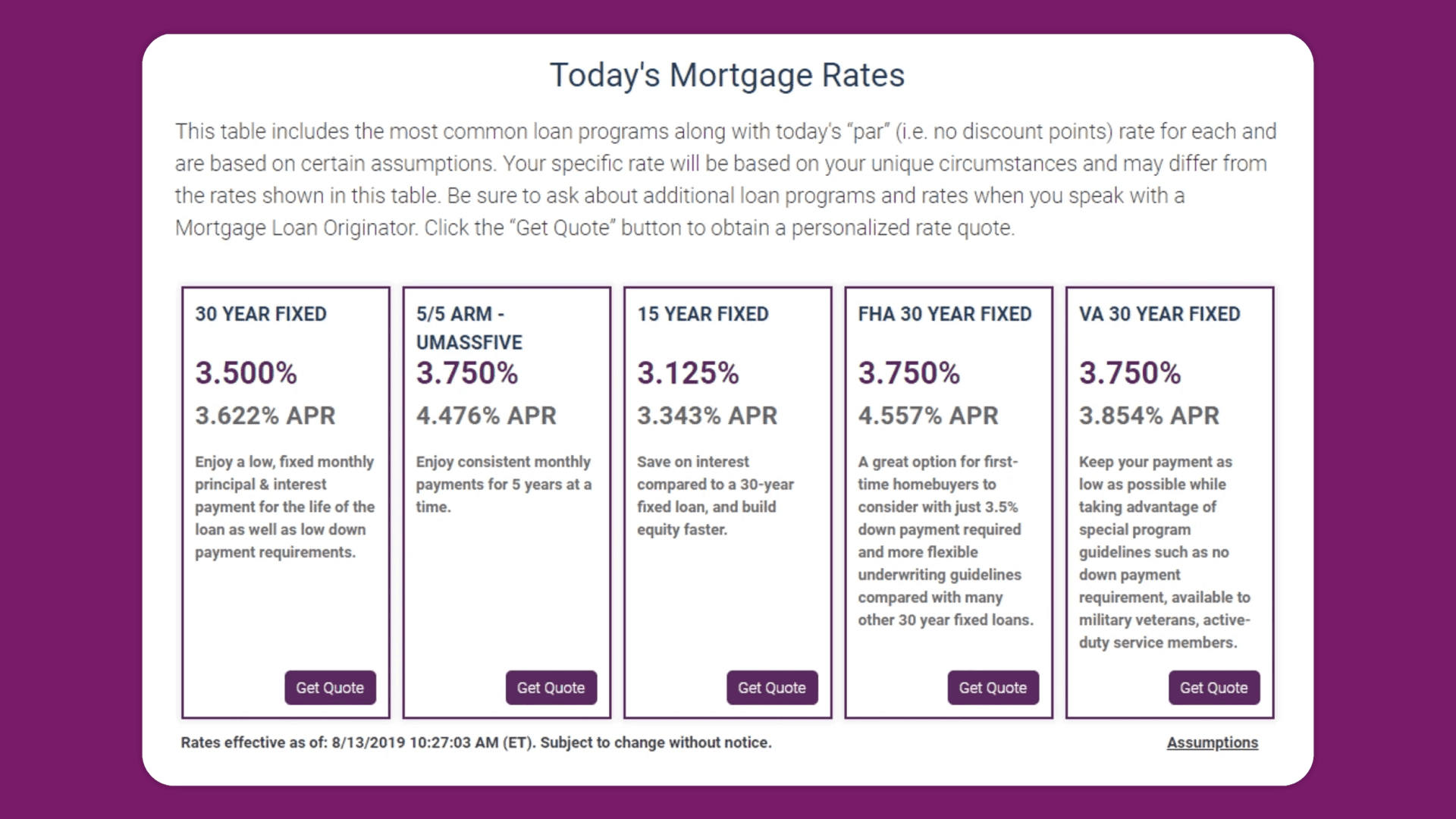

Current Mortgage Rate Widget

This widget dynamically pulls the up-to-date mortgage rates for each mortgage product and for a specific loan scenario, while following important legal regulations. We were able to develop an integration with their Loan Origination System, Mortgage Cadence. The mortgage rate widget allows every website visitor to quickly attain real-time rate information and request a detailed quote from a mortgage loan officer.

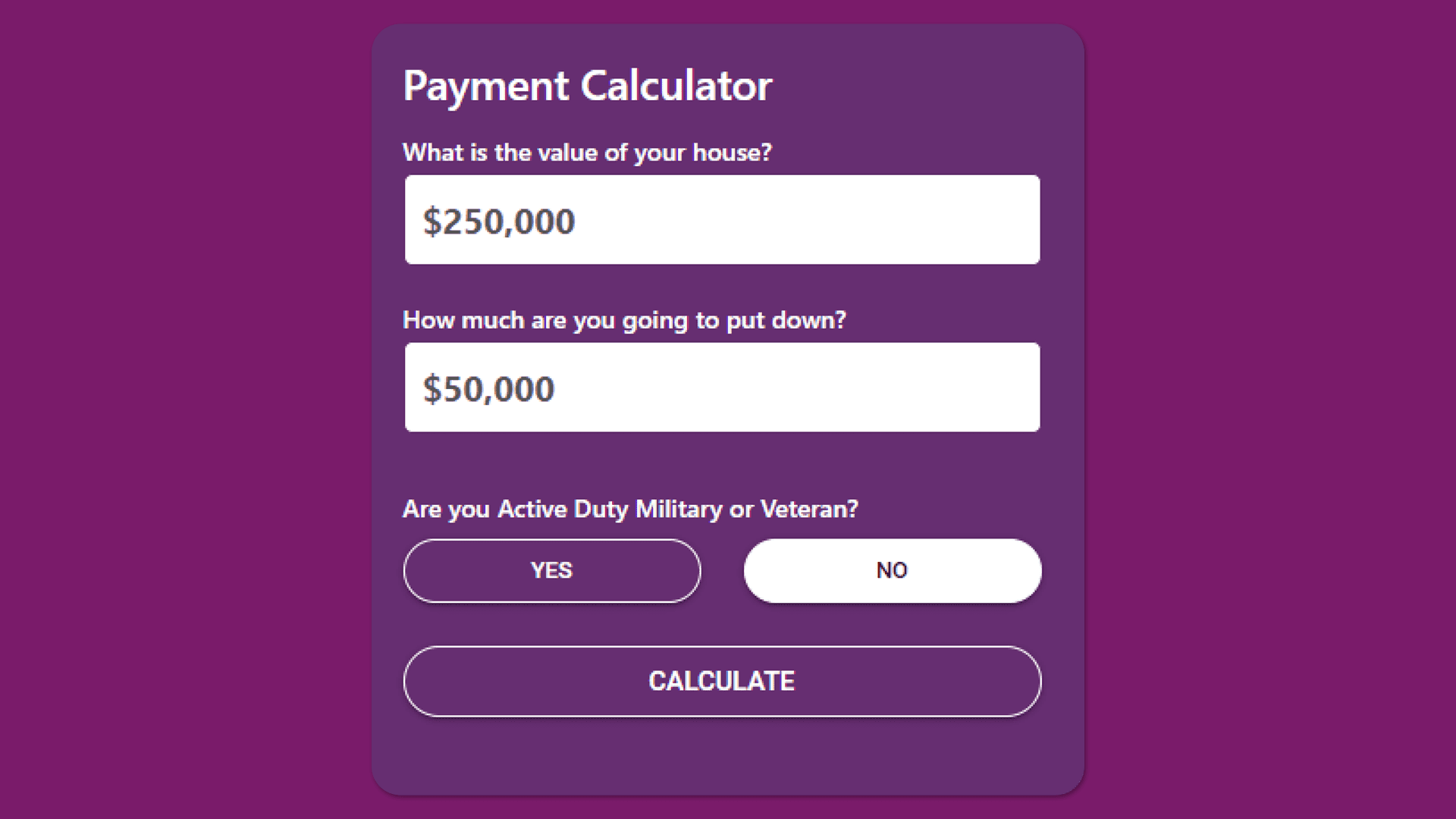

Mortgage Calculator

This widget helps users engage and experiment with various mortgage products and rates. It supports both purchase and refinance scenarios. Upon entering the cost of a house and the percent down payment you’re willing to spend, the calculator then produces your monthly mortgage payment for each loan product with accurate rates and pricing information based on today’s real-time rates, helping users easily understand what they can afford. This widget also guides customers into a lead capture form that enables them to get a detailed quote and speak with a Mortgage Loan Officer (MLO).

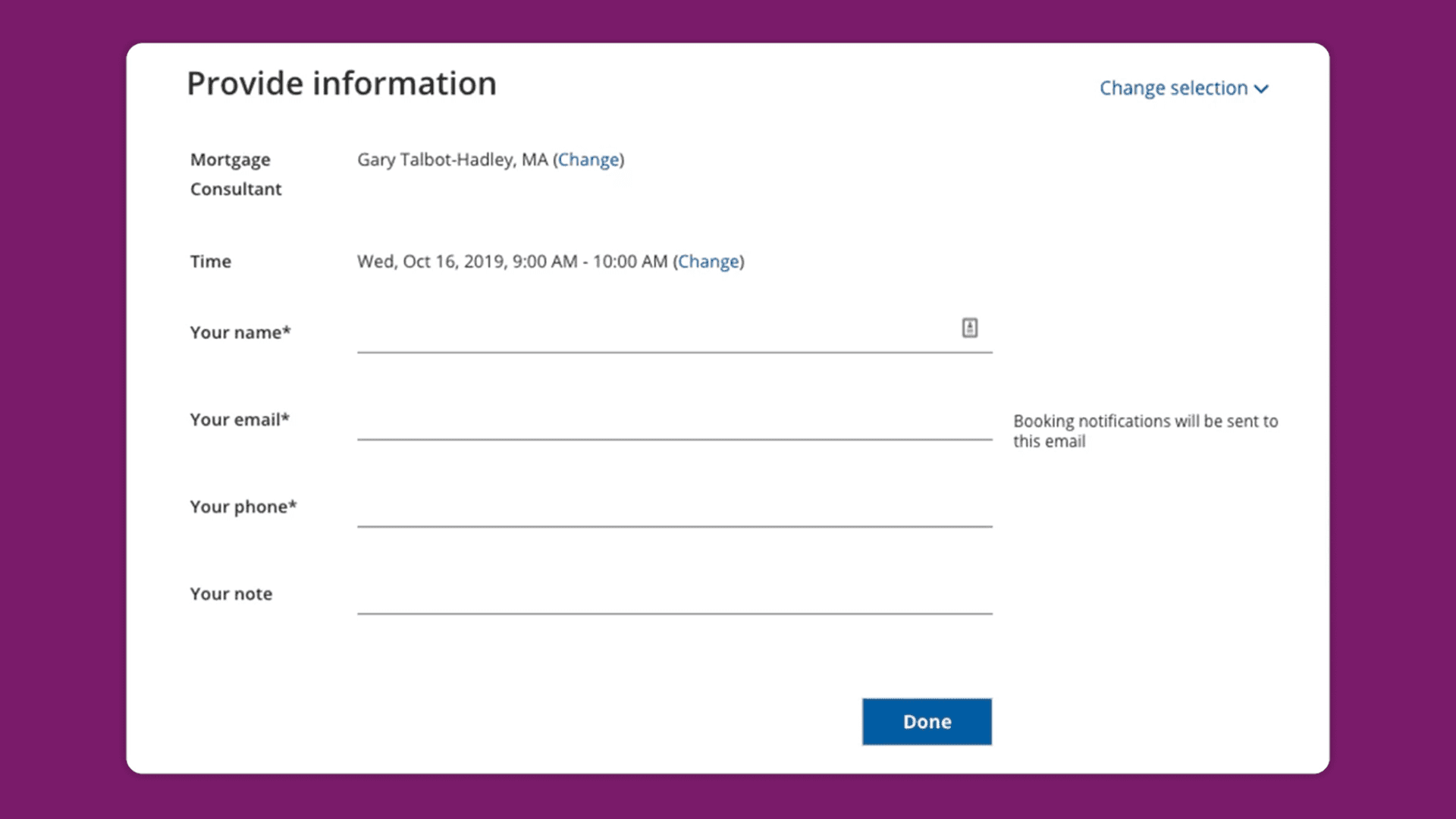

Lead Capture Form

This widget answers the potential customer’s question: “What do I do now?” It asks users to provide just their name, phone number, and address, then tracks exactly what they viewed on the website so each customer service representative will know how best to follow up. This information is automatically entered into their CRM (Velocify by Ellie Mae) and is distributed to MLO’s for follow up.

Additionally, Augusto designed a behind-the-scenes analytics and reporting tool that integrates with Google Analytics and allows the credit unions to evaluate daily impressions and click-through-rates, and determine how many of those visitors turned into leads.

The Results

Transforming a Confusing Journey Across Lenders

The main challenge in this engagement with MAM was making it simple for customers to acquire accurate mortgage quotes, while easily connecting with MLOs for support throughout the mortgage financing process. We also wanted to enable MAM to easily integrate a lead generation strategy from each of their CU partner websites.

An additional challenge was designing widgets in a flexible, easy to implement way. Credit unions don’t usually invest heavily in a full development department, so we guaranteed that their team could easily drop the widgets onto their webpages – leaving them to focus on the work they’re best at. By implementing our measurement strategy when we delivered the first credit union’s widget package, we were able to instantly watch as new users began interacting with the widgets. We held many conversations to measure our desired outcomes. The significant increase of new leads from MAM’s initial CU partner proved we were on the right track. MAM is now expanding to other CU partners, and we are helping them implement and iterate on their vision. The future seems bright for MAM, and we are thankful to be their digital engineering partner on their path to success!

Real Results

Custom widgets embedded on CU websites

Augusto delivered branded rate, calculator, and lead widgets that seamlessly integrate with each credit union’s site—no dev team required.

Lead volume boosted through simplified UX

Redesigned mortgage journeys turned complex clicks into clear conversions, generating measurable lead increases from initial CU partners.

Real-time mortgage rates + CRM integration

Widgets connected to Mortgage Cadence and Velocify, enabling instant quotes and lead capture with automated follow-up.